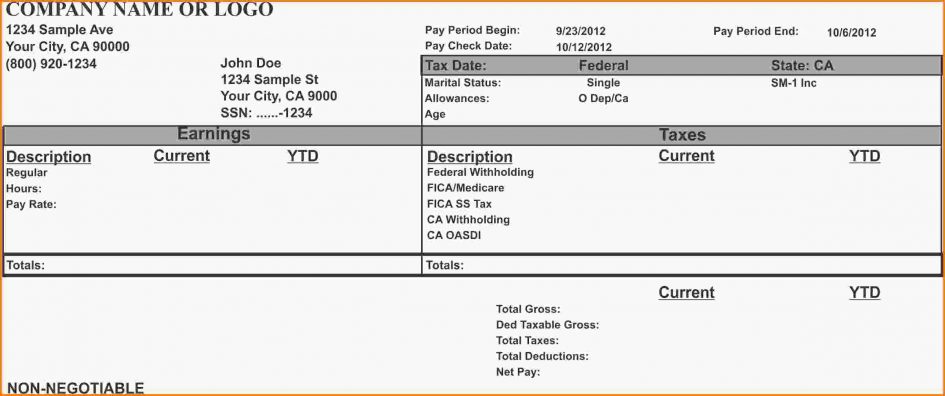

When you receive your first pay check, it is likely that you will be a bit surprised at various paycheck deductions. If it is your first job, you may or may not give proper attention to different items that are on your paycheck. If you are like most people, and tend to avoid the pain of going through to understand your paycheck carefully each time, you are likely to miss out.

Breaking down the items on your pay stub, you will see where the funds are going. A salary of $40,000 does not mean $40,000 will be transferred to your bank account. You can also learn how to make pre-tax savings or deductions, which can reduce your tax bill. Therefore, it is vital to fully understand the breakup of the amount withheld and the purpose for withholding.

In addition, if you get a salary bump, you might not notice as much increase in your take-home salary as you thought. This is because your applicable tax rate may increase based on the amount of your pay raise. A thorough knowledge of your paycheck will help you understand why this usually happens. This is a list of items you are likely to find on your paycheck and what they mean.

Gross Wages

If you work on a salary basis, this is what you earn each period. In contrast, hourly employees will see their rate (per hour) along with the number of hours they work in a day. In case you qualify for overtime, it will also be tabulated.

If you are a salaried worker, your working hours will be listed as either 35 or 70, based on the frequency of your checks. Also remember that your lunch hour is not a part of your work day for the purpose of calculating gross pay. It is worth documenting your hours carefully to ensure easy comparison with the number of hours reported on the time card.

FICA Med Tax

FICA comprises Social Security and Medicare. These taxes could be listed separately or together. Medicare tax subsidizes the cost of health insurance for individuals of age 65 and above, and for people with disabilities and a few other eligible groups.

FICA SS Tax

Social Security is a governmental program that working Americans contribute to. This amount provides income to different eligible beneficiaries, usually people with disabilities and retirees. Contrary to the claims of certain politicians, this program is unlikely to run out of funds in the near future.

Fed Tax

This is the amount of the paycheck that the federal government receives. It is in addition to Social Security and Medicare. The exact amount will depend on your applicable tax rate and the different allowances you are eligible to receive.

It can be affected by the amount of pre-tax earnings you spend on items such as employee benefits and health insurance, and also by the amount you invest into 529 accounts or retirement accounts.

State Tax

The state you reside in might deduct this tax from your income. You will be happy to know that governments in Florida, Alaska, Nevada, Texas, Washington, South Dakota and Wyoming do not deduct state income tax, while those in Tennessee and New Hampshire only tax your investment income and dividends.

City Tax

Many cities in the U.S. such as Washington, D.C., New York and Detroit also charge an extra city tax.

State Disability Insurance (SDI)

SDI is a type of compensation for workers who sustain an injury off the job, and therefore not able to work. It entitles you to get a specific portion of your salary when you are temporarily disabled or take some time off for pregnancy or tend to a sick relative (under the provisions of Family and Medical Leave Act).

Pre-Tax Deduction

Some paychecks also provide a breakdown of the amount of pre-tax income you contribute towards things like 401(k) contributions and health insurance. This is a simple way to ensure whether you are investing sufficient money into the 401(k) account to receive the employer’s full match.

Filing Status

The paycheck will also list your marital status, and any allowances you are eligible for. These details are stipulated on your W-4 form when you commence your job.

YTD Gross

This is your gross salary times the number of payment periods in the calendar year so far.

Current Deductions

This is the sum of money deducted from the current payment period and paid to city, state and federal governments, and into your insurance and 401(k) account.

YTD Deduction

Is the aggregate sum of money you have paid in the form of taxes. This is to your insurance provider and invested into the 401(k) account to date in the current calendar year.

Net Pay

This is the amount of money transferred to your bank account in the current pay period. It goes without saying it will be considerably less than your gross pay. Do not worry about it too much, especially if it is your initial paycheck; and many friends will tell you that you can live on it. Moreover, it will only increase in the future.

YTD Net Pay

This indicates the amount of money transferred to your bank account to date in the current year. It is usually a source of consternation and pain; however, at other times it could be the reason for your joy. And the best part is that you can always improve it with some hard work and extra hours.