Overview

Betterment is the largest robo-advisor service currently on the market. With an impressive $10+ billion under management, they are responsible for a lot of money.

Betterment is one of the first and now largest robo-advisor services in the investing realm. With Betterment, you create an ETF portfolio that invests in several different funds consisting of stocks and bonds based on your risk tolerance and investing goals. As certain asset classes outperform the market and underperform the market, robo-advisors automatically rebalance your portfolio so it doesn’t become too aggressive or too conservative.

Your parents or grandparents might use a financial advisor who does the same thing but costs more money. For example, Betterment charges 0.25% to manage your investments while a financial advisor charges 1.35%. Those investment management fees ultimately reduce your total account value and mean you can have tens of thousands fewer dollars to spend in retirement.

This Betterment review will help determine if automated investing with Betterment is a good option for you.

Table of Contents

Getting Started

To start investing with Betterment, you only need $1 to make your first investment. Although, you can create an account for free without an initial commitment.

If you want access to their financial advisor team, you will need a minimum account balance of $100,000. Even if you open an account with an initial balance of $100,000, the advisory service is optional if you just want the basic plan to automate your investments to only pay 0.25% instead of 0.40% in annual management fees.

The onboarding process only takes a few minutes. You will first be asked your name and annual income. The next screen will take you to three different investment goals: Safety Net, Retirement, or General Investing. Unlike other brokerages, there isn’t a quiz determining your risk tolerance based on several hypothetical market conditions.

The safety net goal is the most conservative strategy and an ideal place to park a portion of your emergency savings. You can also open a Traditional IRA, Roth IRA, or rollover your 401k to Betterment for your retirement goals.

At this point, you will create an account and submit all the necessary tax information. You can also create a joint account at this time as well. This can be beneficial if you plan to use Betterment’s tax-harvesting tools that come standard with both investment plans.

After creating an account, you will be able to adjust your asset allocation between stocks and bonds using a sliding scale from 0% to 100% stocks if you do not agree with Betterment’s recommendation based on your age. Betterment’s suggestion stock allocation will always be at least 55% and never exceed 90%.

Finally, Betterment will allow you to fund your account and make your first investment. Using a graph, Betterment will show you the best-case and worst-case end balances for when you retire based on your one-time or monthly commitment. Don’t worry, you can always increase the commitment later.

Screen Shots

Betterment Features

| Account Minimums | The minimum deposit is $1, but you never need to maintain a minimum balance. Access to financial advisors requires an account balance of $100,000. |

| Accounts Supported | Traditional IRA, Roth IRA, SEP IRA, Rollover 401(k) and Individual |

| Account Management Fees | Betterment charges and an annual fee of 0.25% of your account balance for Digital Plan and 0.40% for accounts with financial advisor access. There are no fees to transfer your taxable account or retirement accounts to another broker. No other fees. |

| Investment Expense Fees | The average ETF expense ratio is between 0.03% and 0.15%, some international and specialty funds charge more. The investment expense fees are listed here |

| Asset Allocation | ETFs from 12 asset classes. Additional ETFs may be used for tax-loss harvesting. |

| Tax Harvesting | Yes – Complimentary with every plan. |

| Auto Re-balancing | Yes |

| Mobile App | Yes – You can download the iOS app here and Android app here. |

| Customer Support | Phone/Live Chat — M-F 9A-8P ET, Saturday (Live Chat only) 11A-6P ET, Email — 24/7 |

Asset Allocation

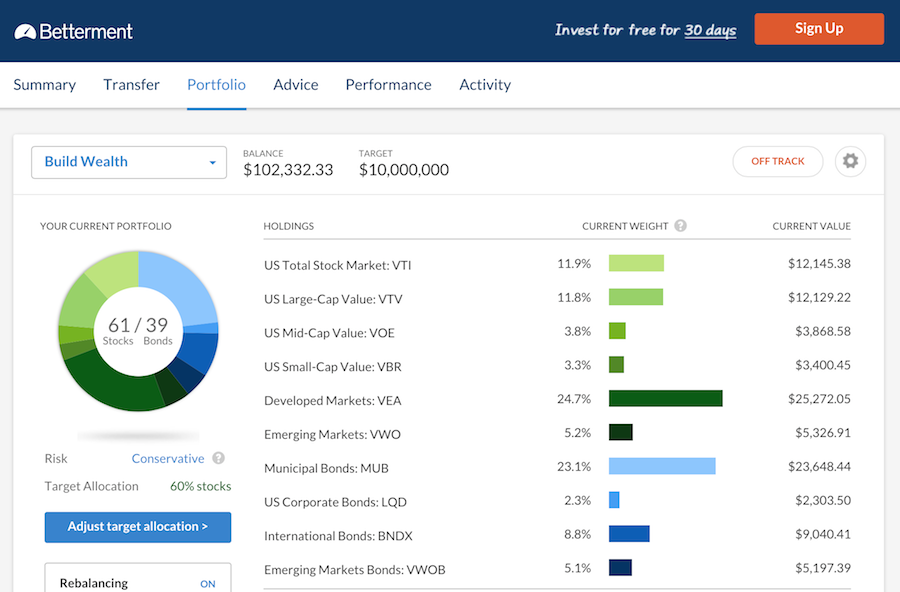

Betterment invests in stock and bond ETFs (Exchange Traded Funds) primarily managed by Vanguard and iShares. Your portfolio might hold up to 12 different ETFs to help diversify your portfolio against market risk and losing everything. The average fund expense ratio is 0.12% which is pretty good.

When investing in Betterment, you can expect your investment to be spread across the following categories:

Stocks

- U.S. Total Stock Market

- U.S. Large-Cap Value

- U.S. Mid-Cap Value

- U.S. Small-Cap Value

- Developed International Markets

- Emerging International Markets

Bonds

- Total Bond Market ETF

- U.S. Corporate Bonds

- U.S. Treasury Inflation-Protected (TIPs) Bonds

- International Bonds

- Emerging Markets Bonds

- AMT-Free Muni Bonds (Taxable Accounts Only)

Remember, your Betterment portfolio might not have all of these categories at the same time. It largely depends on your risk tolerance, portfolio size, and account type (taxable or non-taxable account).

Unlike a DIY brokerage account where you manually invest in each ETF and rebalance yourself, Betterment chooses the initial asset allocation and will automatically rebalance your portfolio as necessary. As you approach retirement, Betterment will also recalibrate your portfolio by selling stocks and adding bonds.

Tax Loss Harvesting

Betterment will automatically perform tax-loss harvesting with every portfolio. This allows you to save money at tax time by selling investments for a loss and immediately invest the money in a similar fund and keep your investment strategy intact.

By linking your spouse’s account, Betterment will make the loss harvesting isn’t duplicated and potentially cancel any tax savings. This might happen if both accounts have different portfolio allocations

Tax Coordinated Investing

Another complimentary feature with all Betterment plans, tax coordinated investing will buy more expensive plans in your tax-advantaged retirement accounts and keep the less expensive funds in your taxable account. This is another way Betterment can minimize your tax bill in ways a DIY investor is unaware of.

Three Unique Investing Strategies

Although you can’t pick the exact ETFs you want to invest in your ETF portfolio, Betterment does offer three focused investing strategies:

- Betterment Socially Responsible Investing

- Goldman Sachs Smart Beta (More aggressive investing while keeping risk exposure to a minimum)

- BlackRock Target Income (100% bonds)

You will need to manually opt-in to these three portfolio strategies. You can invest a portion of your portfolio or your entire balance in these three options–it’s your choice.

How Much Does Betterment Cost?

Betterment has two different subscription plans.

Digital Plan: $0 minimum balance and you will pay 0.25% annually on the first $2 million. The management fee is 0% in excess of $2 million. This plan doesn’t give you access to a Certified Financial Planner (CFP).

Premium Plan: $100,000 minimum account balance required. The annual management fee is 0.40% and you have unlimited access to Betterment’s CFP team.

With either plan, the ETF expense fees are additional and withheld from the dividends. There are no fees for rebalancing, transfer fees, or trades. And the tax loss harvesting and tax coordinated investing benefits are complimentary with all plans.

Competitor Comparison

|

|

|

||

| Review | Read Review | Read Review | ||

| Rating | 7.8 | 9.8 | 9.5 | |

| Features |

|

|

|

|

| Fees |

|

|

|

|

| Asset Allocation |

|

|

|

Summary

Betterment is an excellent option if you want to use an established robo-advisor with plenty of positive customer reviews. They are also a good option if you eventually plan to access a CFP. While you can truly let Betterment make every investment decision for you, their RetireGuide can help you determine if you are saving enough to afford your retirement goals.

If you are truly looking for the cheapest no-frills robo-advisor, Wise Banyan can give you access to similar ETF portfolios with 0% management fees when you don’t want to pay extra for tax-optimized investing. If human CFP availability is important to you, WiseBanyan doesn’t offer any CFP access.

Betterment is a good option if you want a managed portfolio but don’t want the higher fees charged by financial advisors or target date retirement funds.

Pros of Investing with Betterment

Here are a few reasons you might enjoy investing with Betterment:

- Entry-level account fee is 0.25% of account balance

- Access to financial advisor (very rare for robo-advisors) with minimum balance of $100,000

- Complimentary Tax-Loss Harvesting and Tax-Coordinated Investing

- RetireGuide makes retirement planning easier

- Low-cost ETFs

- Diverse Asset Allocation

- Fractional Investing

- Great Customer Service

Cons of Investing with Betterment

While Betterment is one of the largest robo-advisors for a reason, it isn’t perfect. Here are a few downsides:

- DIY investors can successfully invest in same ETF categories without the management fee.

- Doesn’t invest in alternative categories like Real Estate Investment Trusts

- CFP access might not be worth the additional fee

- Cannot access CFP advice until you have $100,000 in managed assets

Is Betterment Right For You?

If you are interested in hands-off investing, Betterment is one of the best choices. Especially if you want complimentary tax-loss harvesting and tax-coordinated investing or plan to eventually use their CFP service. Other robo-advisors are cheaper if you have a small account balance (i.e. Wealthfront and WiseBanyan). But, Betterment’s sound asset allocation and selection of top-performing Vanguard and iShares ETFs are hard to compete with. Plus, they have an easy-to-use and feature-rich website too.