Overview

If you are concerned the new hybrid digital-human robo-advisors could turn into a Frankenstein, Fidelity Go has placed a human back at the controls. Fidelity Go is a new breed of robo-advisor targeted to the young digital investor. While other robo-advisors will provide you with a human advisor to provide investment advice, Fidelity has gone father to remain faithful to the traditional investment management model.

Fidelity investment managers still watch over and manage your portfolio, alongside some smart algorithms. The professional money management is provided at advisory fees competitive with other robo-advisors.

Founding: 2016

Assets Under Management: Over $5 billion

Client Profile: Young, digitally savvy investors in the 25-to-45 age range.

Minimum Investment: $5,000

Table of Contents

Getting Started

What do you need to start?

Digital wealth managers typically provide short and sweet questionnaires; this one is shorter than most.

Fidelity Go’s approach is to provide you with the very basics and give you the option to access more in-depth portfolio analysis tools at no extra charge, if you so choose. Investing a few more minutes of your time in producing a more accurate risk assessment is essential.

What questions do they ask?

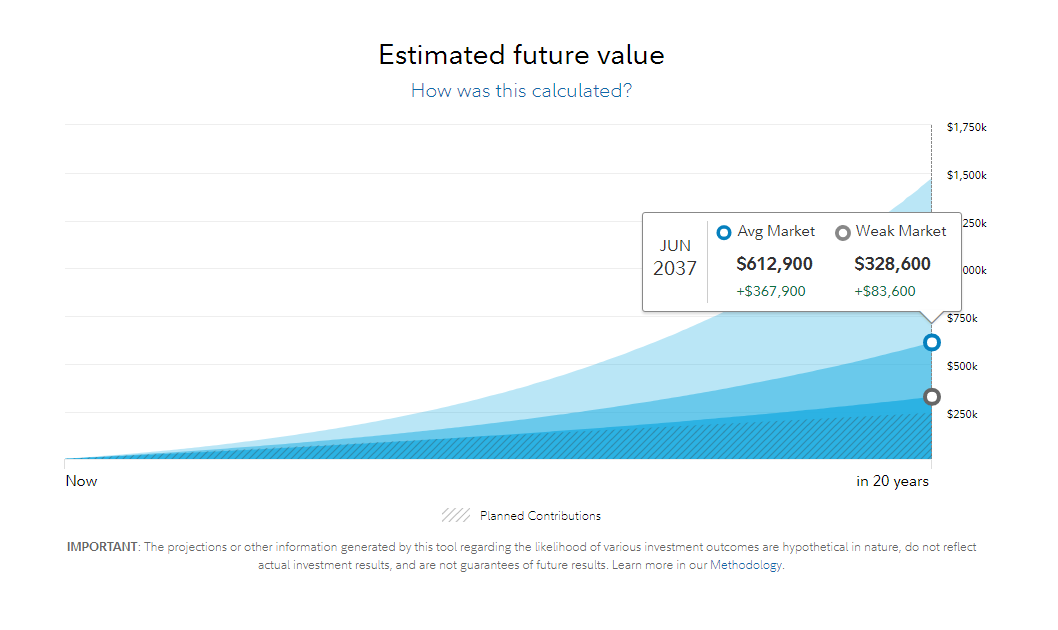

You will be asked to provide the very basic information in seven questions on age, individual or joint account, investment objective, income, account deposit, and risk profile. Your suggested portfolio then pops up with an estimate of its future value under different market conditions, and costs – about $1.60 a month for a $5,000 account balance.

How is risk tolerance assessed?

For risk tolerance, you will simply be asked to rate your own risk tolerance on a scale of 1 (Risk-Averse) to 10 (Very Aggressive). Does a “7” represent a 60-year-old female with an average income or a 55- year-old male with a six-figure income?

We put a “7” for both profiles and we received the same 70% stock allocation for both profiles, with a 21% holding in foreign stocks.

Take the time to complete the expanded questionnaire for a more accurate assessment. Creating a lower risk profile for the 55-year-old male, dropped the stock allocation to 60 percent and the monthly fee to $1.58 for a $5,000 balance.

If you don’t feel comfortable taking this quiz without professional help, you can also call an investment professional at 800-823-0125 to walk you through the process. Only you can determine how aggressive or passive you want your investing strategy to be, but Fidelity’s support team can mean the difference between being too risky or too passive and underperform the market.

ScreenShots

Platform Features

Fidelity Go’s interface is barebones even for a robo-advisor. Its goal is to have your retirement portfolio up and running within a few minutes. Once your portfolio goes live and your ETFs produce returns, you can monitor your account online and conduct portfolio analysis to see how your portfolio will perform over the long term, under different market conditions.

Remember, unlike other robo-advisors, Fidelity investment managers are also behind-the-scenes monitoring your daily performance and rebalancing your portfolio as required. Many other robo-advisors rely on purely automated account rebalancing.

Dashboard – You will find the robo-advisor to be a very different experience from the Fidelity online trader desktop and its dizzying choice of sections to choose from. With the robo-advisor now making all the investment decisions behind the scenes, you have only a few decisions to make per page.

You will be greeted by an overview of your account: your portfolio holdings, cost per month (about $1.50 – $1.60), and an intuitive estimated future value graph, allowing you to view your portfolio over the next 20 years under different market conditions. If you want to conduct more detailed portfolio analysis and financial planning, the tools are only a click away.

Financial Planner – As a Fidelity Go client, you will have free access to Fidelity’s powerful Planning and Guidance Center. Here, you can link your Fidelity and non-Fidelity accounts to create a complete financial picture. This goal tracker is not limited to retirement planning. You can also develop plans and explore scenarios for investment, college, and or any other financial plan you choose to create.

Although the retirement analysis tools are more comprehensive. You may create hypothetical retirement income under different market conditions and see potential gaps. Here is where the risk analysis tools become more useful.

You may explore different risk scenarios at the asset class and individual fund scenario level. Within 10 years of retirement, the tool becomes more precise, providing information on how volatility, inflation, spending and health care will affect your retirement savings and income.

Integration – Accounts can be accessed from desktop and mobile devices.

Fidelity Go Features

| Account Minimums | The minimum deposit is $5,000. |

| Accounts Supported | Taxable: Individual, Joint; IRAs, Roth IRAs, 401(k) Rollovers |

| Account Management Fees | 0.35% |

| Investment Expense Fees | 0.30 – 0.40 % |

| Asset Allocation | Fidelity ETFs and index mutual funds. |

| Tax Harvesting | No. |

| Auto Re-balancing | Yes. Free. |

| Dividend Reinvestments | No |

| Mobile App | Yes – You can download the iOS app here and Android app here. |

| Human Advisors | Yes |

| Customer Support | Phone 24/7/Live Chat — M-F 8 am-10 pm ET, S-S 9 am-4 pm |

Different from other robo-advisor offerings, Fidelity Go creates a diversified portfolio that includes index mutual funds as well as the standard exchange traded funds. Both passive index funds and ETFs are low-cost index tracking funds that outperform active managers over time. The differences between indexes and ETFs can affect performance (see below).

The digital wealth manager focuses on low-cost funds by comparing the net expense ratio to similar funds in the same asset class. You may also benefit from allocations of institutional class funds with lower fees than those of the Investor class funds many individual investors with a lower account balance would be allocated.

Fidelity Go clients receive free access to Fidelity’s financial planning tools. Whether you are planning for retirement, or another financial goal – a car, a vacation, college – you will receive an easy-to-follow visual display of your future plans and ‘what if’ scenarios.

Unlike Wealthfront, WealthSimple, and a few other robo-advisors, you cannot fund your account by transferring securities in kind at this time. You will have to sell your existing securities and repurchase them at market price, even if you currently own the same Fidelity funds.

Asset Allocation

Fidelity Go first invests in Fidelity Index funds (both mutual fund indexes and ETFs) and then Blackrock ETFs. If it cannot meet its low-cost funds requirement, it will look beyond these ETF families for low-cost funds. The Fidelity index fund family includes:

- 19 Fidelity equity, fixed income and hybrid index mutual funds,

- 13 Fidelity Freedom® Index Funds

- 12 Fidelity passive ETFs.

Similar to Vanguard, Fidelity has three fund classifications – Investor, Premium and Institutional whose fund expense fees decline as the minimum balance increases. In the hypothetical portfolio, most index funds were of the Institutional class and a few were from the Premium class, providing investors a lower cost advantage.

As a regular Fidelity investor with a minimum balance under $10,000, you would be subject to the highest fees in the Investor class. Fidelity would automatically bump you up as your balance increases. Fidelity Go provides you access to the lower fee premium classes.

Competitor Comparison

|

Fidelity Go |

Betterment |

Wealthfront |

|

| Review | |||

| Rating | 9.5 |

9.8 |

9.5 |

| Features |

|

|

|

| Fees | 0.35% for all assets |

|

|

| Asset Allocation | Invests in U.S. and International stock and bond ETFs | Invests in U.S. and International stock and bond ETFs | Invests in U.S. and International stock and bond ETFs |

Summary

Machines are not taking over the investment world after all. Even digitally savvy millennials are willing to pay more for some human guidance, finds a recent E*Trade study. An important distinction between Fidelity Go and many other robo-advisors is it is being managed and rebalanced in line with your risk tolerance by a human advisor. One advantage of human advisors is the ability to opportunistically leverage the different advantages of mutual fund indexes and ETFs to improve performance.

Mutual fund indices have lower all-in costs than ETFs. This cost advantage could help the fund giant deliver on its “low cost funds” promise. Furthermore, mutual fund indexes can immediately reinvest dividends whereas, as trusts, ETFs distribute dividends quarterly. Compound dividend interest can significantly increase a fund’s returns. ETFs trade daily like stocks whereas mutual funds are settled daily. For long-term buy-and-hold investors, the trading advantage is less important.

Pros of Fidelity Go

You may like Fidelity Go for the following reasons:

- Competitive advisory fees of 0.35% do not increase with account balances

- 0.02% fee discount with Fidelity Rewards Visa Signature cash back

- Free phone financial consultation

- Free access to Fidelity’s powerful Planning and Guidance Center

Cons of Fidelity Go

The reasons below might be why you won’t like Fidelity Go.

- No access to human advisors <$500,000

- Use of proprietary Fidelity ETFs

- Fund fees of 0.30-0.40 are in the high range

- No daily tax-loss harvesting

Is Fidelity Go Right for You?

Times are a changing for traditional fund management. Fidelity Go fees are competitive. As your account balance grows, the value adds up. You will be receiving professional portfolio management and Fidelity’s powerful forecasting tools for the price of a robo-advisor.

If you want a powerful financial planner for all your life investment goals the Fidelity Planning and Guidance Center is in itself a good investment.

Many robo-advisors provide a basic portfolio monitoring and goal tracking tool. Fidelity’s financial planning tool is not only limited to your retirement account. This powerful tool connects all your financial accounts and forecasts any financial goal you create, from college to charity giving.