The threat of a wage garnishment is one of the tactics collection agencies use to scare consumers into paying a debt. It’s illegal for debt collectors to make threats they cannot or do not intend to follow through on. But that’s not all, state and Federal laws may limit the debt collector’s ability to garnish your wages. Being aware of these laws can help you know whether you should be afraid of a wage garnishment threat.

State Wage Garnishment Laws

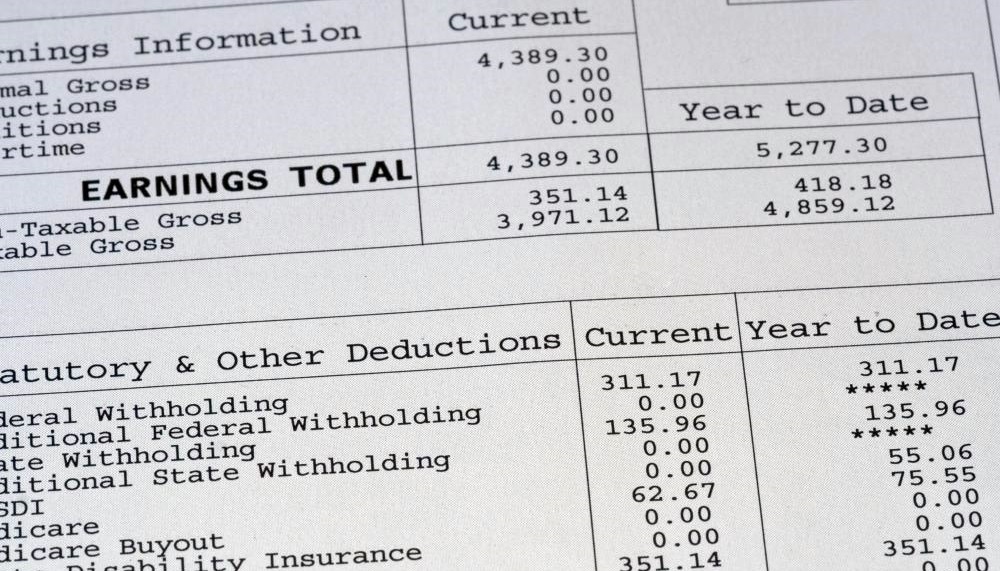

The laws regarding wage garnishment can vary from state to state. Some states don’t allow wage garnishments at all. Even in those states, child support and student loan payments may still have to be paid. In states that do allow garnishments, there are usually limits on the amount that can be garnished. You should still be left with enough money to afford a basic cost of living even after a garnishment.

A Few Steps Leading Up to Wage Garnishment

If your creditors have made repeated attempts to get you to pay what you owe, don’t be surprised if your employer notifies you of a wage garnishment.

Even in the states where garnishment is legal, creditors can’t garnish your wages without first going through a few necessary steps. The creditor has to sue you, win. Then, if you haven’t paid, ask the court for permission to garnish your wages. If all this has happened without you knowing, you can file documents with the court to stop the wage garnishment. For example, if you were not properly served after the lawsuit was filed you may be able to have the judgment vacated. Contact an attorney to help you with the legal process.

Don’t ignore a lawsuit summons. If you fail to show up in court, the creditor can automatically win their case against you for the full amount of the lawsuit. After that, they can follow up by asking for permission to garnish your wages. By going to court and defending yourself, you may be able to work out a payment arrangement that’s more convenient than having your wages garnished.

Not All Debt Collectors Are Scammers

There are plenty of companies posing as debt collectors, whose goal is to scam consumers out of money. But don’t assume that any company threatening a wage garnishment is a scammer. There are also legitimate debt collectors who are pursuing debts they’re legally allowed to collect on.

Credit cards make it incredibly convenient to enjoy things now and postpone paying for them until another day. Life doesn’t always work out perfectly and circumstances can leave you unable to stick to your agreement to pay your debts.

Unfortunately, a change in your finances doesn’t relieve you of your obligation to pay back what you owe. Your creditors won’t forgive your debts simply because you’ve fallen on hard times. They’re fully within their rights to pursue collection actions, including suing you and getting court permission to garnish your wages. Knowing that this is a possibility, aim to stick to your payments and contact your creditors if you’re having trouble.