You’ve heard about the stock market, and you may have even thought it would be fun to dip your toe into investing in a stock or two, but what does that mean and where do you buy stocks? These are really common questions among new investors and finding the answer sometimes is enough to turn them away, but it doesn’t have to be difficult.

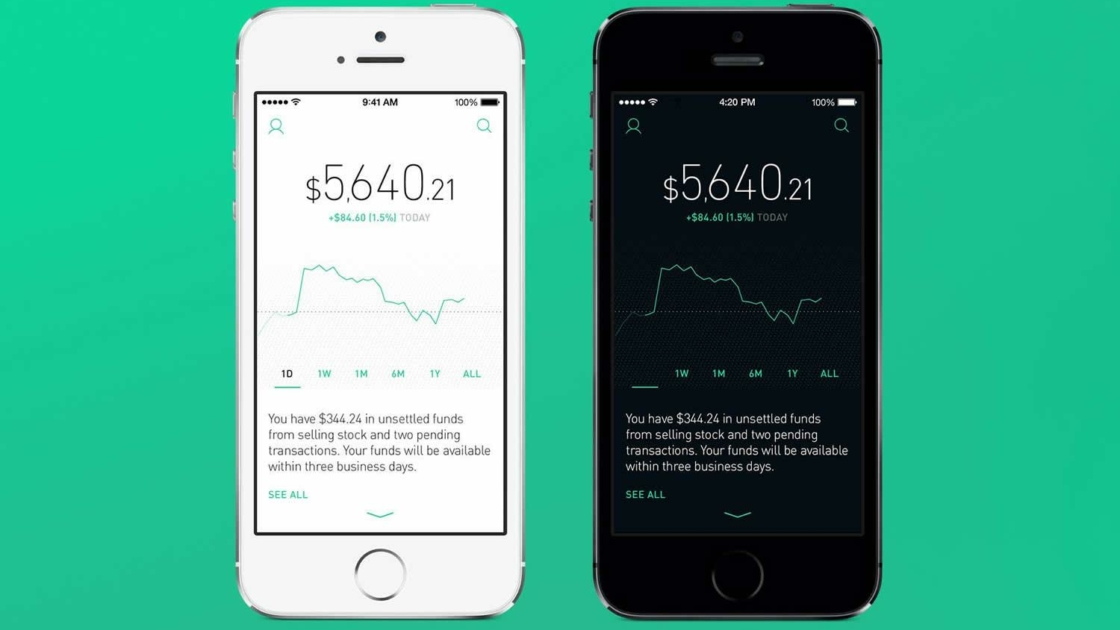

Enter the Robinhood app. This app lets you trade stocks without the traditional fees associated with stock trading. Let’s take a look at its offerings and what it looks like to use in real life.

Pros

One of the major selling points for Robinhood is that it’s commission-free. Now, if you’re a new investor, that doesn’t mean much to you. Basically, when you buy a stock, you don’t pay a person or a company to make that transaction for you; it’s all done by you on your phone for free. As a comparison, many apps and similar services will charge around $10 per transaction.

Another big pro to Robinhood is that there’s no minimum amount to start. In my case, I simply bought a $5 Fitbit stock and I was in the game. Other companies may require $1,000 or more to start trading, adding to the reasons why people shy away from the stock market.

The biggest pro, in my opinion, is the app itself. It’s fast and streamlined so you can instantly verify your bank account and check on your investments or make trades with only a few taps.

Cons

Sometimes simple is better, unless you’re looking for more options. Robinhood app won’t give you many companies to invest in, but they’ve said they hope to widen their offerings in the future. Additionally, they only offer these options to buy stocks; you can’t choose to invest in an IRA or other common retirement account options.

The other drawback is that unlike many investment tools, the app lacks a range of education offerings for potential investors. Many investment companies will have a knowledge center for people who want to go one level deeper with their investment options.

Personal Experience With The Robinhood App

Here’s what my experience with Robinhood has been like:

I was a new to this area of investments, and I’m also not rich. I only wanted to dip my toe in the water and see what it’s like. To my surprise, I enjoyed the experience. So, I bought one stock in Fitbit, frankly, because it was the most affordable stock at the time. The process was simple. I deposited money into my Robinhood account, bought the stock, and that was it.

Then I added the Robinhood widget to my homescreen so I could watch how my investment performs. No fees involved.

After that, I decided to buy and sell a few more stocks to see how they would do as well. The only drawback is the range of stocks available to investors. It jumps from an affordable $10 stock to a $300 Tesla stock, with about 10 options in between that range from Ford to Microsoft to Apple. But all told, it’s been like playing neverending Draftkings, only with less risk.