Overview

WiseBanyan is the first fee-free robo-advisor. This allows you to invest in a managed portfolio for the lowest possible price. Using a robo-advisor can be an easy and affordable way to start investing. This WiseBanyan review will help you decide if it’s the best investment platform for you.

WiseBanyan Review

Table of Contents

Getting Started with WiseBanyan

To begin investing with WiseBanyan, you only need $1 to make your initial investment. For subsequent investments, you can commit $0 or as much as you want. Regular monthly installments are not required, but, it is recommended to make regular monthly contributions to your investments account(s) even if you do not choose to use WiseBanyan. Routine investing allows you to earn compound interest and reduce the effect of the market ups and downs. By only choosing to “buy low” and trying to time the market can cause your earning potential can sharply decrease.

When you begin the five-minute signup process with WiseBanyan, you will be asked several personal questions including your e-mail address, salary, personal net worth, and questions to develop an investment plan. To create your investment plan, you first need to choose an investment milestone as that can affect the way WiseBanyan will invest your money. Don’t worry, you can add additional milestones later.

Some of the questions in the investment plan questionnaire will gauge your risk tolerance. One hypothetical question will ask if you would buy more, hold, sell some, or sell all your assets if a sharp market correction occurred. Additional questions will ask your desired portfolio rate of return and your investment goals and time horizon.

After you have completed the investment questionnaire, WiseBanyan will take you to a screen with a recommended asset allocation based on your questionnaire responses. For example, if you are 20 years old and willing to risk it all, you might invest in 100% stocks, but, a 55-year-old planning to retire in five years might have an asset allocation of 60% stocks and 40% bonds. You can adjust your asset allocation to be more aggressive or conservative if you do not want to follow WiseBanyan’s recommendations.

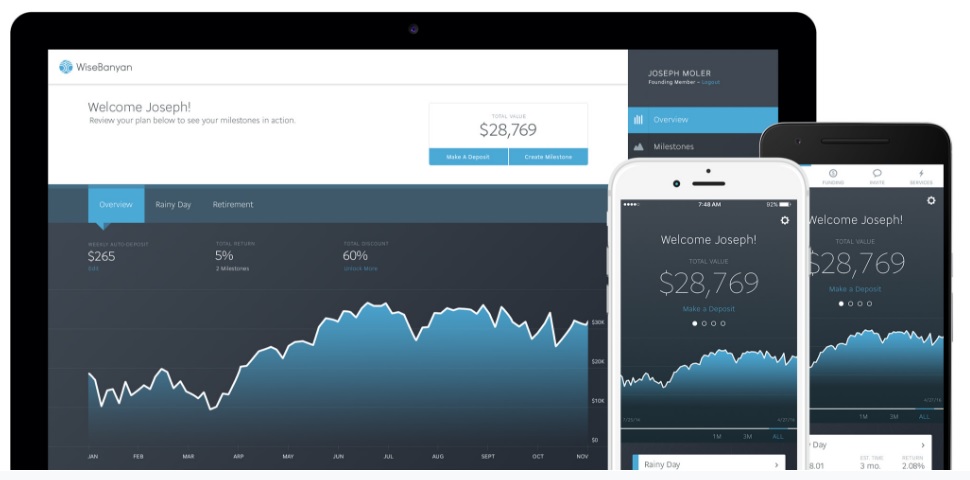

Once you have finalized your asset allocation, it is time to fund your account. In a matter of seconds, WiseBanyan can link to your online bank account and schedule the first withdrawal. You can complete the signup process and monitor your account from your computer or their mobile app.

Both the web interface and mobile app are easy to use for scheduling and tracking investments. One small complaint is that the WiseBanyan website and app are relatively “spartan” and lack many of the features that other brokerages offer like investment news, research reports, and financial calculators. But, this is how WiseBanyan can be a free online brokerage.

WiseBanyan Features

| Account Minimums | The minimum deposit is $ 1, but you never need to maintain a minimum balance. |

| Accounts Supported | Traditional IRA, Roth IRA, SEP IRA, Rollover 401(k) and Individual |

| Account Management Fees | WiseBanyan doesn’t charge any fees at the current time; $75 to transfer non-retirement account to another broker; $95 to transfer IRA. No other fees. |

| Investment Expense Fees | The average ETF expense ratio is between 0.03% and 0.15%, some international and specialty funds charge more. The investment expense fees are listed here |

| Asset Allocation | ETFs from nine asset classes. Additional ETFs may be used for tax-loss harvesting. |

| Tax Harvesting | Yes – Available for an additional monthly fee – 0.02% of assets under management, with cap of $20/month |

| Auto Re-balancing | Yes |

| Mobile App | Yes – You can download the iOS app here and Android app here. |

| Customer Support | Phone — M-F 10A-8P ET, Email — 24/7 |

Asset Allocation

WiseBanyan Investment Offerings

WiseBanyan invests in a combination of ETFs managed by iShares, Charles Schwab, and Vanguard. You do not get to choose which funds to invest in, WiseBanyan has a preselected fund for each of the ten different asset classes. If you choose their tax protection package, WiseBanyan will shift your investments to a different ETFs within each asset class to minimize your capital gains tax.

Your asset allocation might 78% stocks & 22% bonds, 90% stock & 10% bonds, or 63% stocks & 37% bonds depending on the risk tolerance determined by your investment questionnaire. WiseBanyan will proportionally invest your portfolio in each asset class and even determine the weightings within the sub-categories for the stock and bond ETFs. As an example, 47% of your stock portion will be invested in the U.S. Equity ETF and the remainder in the international stock ETF categories.

Depending on your asset allocation & risk tolerance, your money will be diversified into the following categories:

- US Equities

- International Developed Equities

- International Emerging Equities

- US Corporate Investment Grade Bonds

- Short-Term Corporate Bonds

- Short-Term Corporate High Yield Bonds

- US Treasuries

- US Inflation Protection Bonds

- REITs (Real Estate Investment Trusts)

- US Dollar Cash Fund

The average ETF expense ratio is between 0.03% and 0.15%, so most of your money will be kept in the market instead of going to the fund managers. This is important whether you only invest $10 or $1,000,000 as fees can quickly reduce your overall balance.

Right now, WiseBanyan does charge an additional fee for an optional tax-loss harvesting service that optimizes your investments to minimize the amount of taxes you pay each year. The current fee is 0.02% of your portfolio value or $20, whichever is the lesser amount. This is how WiseBanyan makes their money.

WiseBanyan Premium Packages

It’s 100% free to invest with WiseBanyan, but they do offer two optional premium packages to improve your investing experience.

Fast Money

WiseBanyan’s Fast Money package offers same-day money transfers and investing. If you use PayPal, you know that for a small additional fee PayPal will instantly transfer money to your debit card in a matter of minutes instead of having to wait one or two days for the money to show up.

For $2 a month, the WiseBanyan Fast Money package gives you these three upgrades:

- Same-day money transfers and investing

- Auto-Deposit Scheduler

- Overdraft Protection

WiseBanyan currently lets you make one automatic monthly investment on the same calendar date each month. With the auto-scheduler, you can choose to invest more than once a month on the days you specify like every Monday or the 1st and 15th.

Finally, if you don’t keep a lot of money in your checking account, your free WiseBanyan withdrawal can trigger an overdraft charge if you have insufficient funds. Those $35 overdraft fees can add up quickly. With the Fast Money package, WiseBanyan will only make a withdrawal if there’s enough money in your account. If there isn’t enough money, WiseBanyan will skip the transfer and you’re not charged an overdraft fee.

This protection alone can pay for itself. Of course, any transfer will happen instantly and be automatically invested so your money can begin earning passive income immediately.

Tax Protection

The WiseBanyan Tax Protection costs either 0.02% of your monthly account balance or $20 a month, whichever is less.

This service is included in Betterment and Wealthfront and if you enable this service, you essentially pay the same annual management fee with WiseBanyan as with Betterment. Your first $10,000 are managed for free with Wealthfront.

The Tax Protection package includes:

- WiseHarvesting–Sell investments at small losses to reduce annual income taxes

- Selective Trading–Won’t invest in similar assets to avoid wash sale rules

- IRA Conversions— Roll your Traditional IRA to Roth IRA so your earning grow tax-free

You will benefit most from the Tax Protection package with a larger account balance when you begin earning sizable earnings. If you only have $100 in your account to get started, the tax savings will be minimal.

WiseBanyan vs Betterment and WealthFront

|

WiseBanyan |

Betterment |

Wealthfront |

||

| Review | Read Review | Read Review | ||

| Rating | 7.8 | 9.8 | 9.5 | |

| Features |

|

|

|

|

| Fees |

|

|

|

|

| Asset Allocation |

|

|

|

Summary

WiseBanyan is a barebones robo-advisor. If you are not concerned about tax optimized investing, WiseBanyan is the cheapest option available because you only pay fund fees. These particular fees are inescapable are passed on by every self-directed brokerage and robo-advisor.

If you decide to pay for WiseBanyan’s premium tax protection package, which costs 0.02% monthly or 0.24% annually, your ongoing costs will only be slightly lower compared to the basic service for Betterment which charges 0.25% annually and you get a few more features with Betterment. Fund fees are separate from the Betterment’s annual account fee.

If you are wanting access to a financial advisor, the best decision will be staying away from WiseBanyan to avoid transferring your account later. For the forseeable future, they do not plan on having a human advisory service. They are a good option if you are simply looking for the cheapest place to invest with a “hands off” approach.

Pros of WiseBanyan

Here’s why you might like investing in WiseBanyan:

- No account management fees that other robo-advisors charge

- Invests in quality funds managed by reputable investment companies

- Can makes trades for $1

- Tax-Loss Harvesting available for an additional fee

- Automated Monthly Trading Can Be Scheduled

- Manages 401k and IRA retirement plans

WiseBanyan makes it quick & easy to open an account. In a matter of minutes, your WiseBanyan account can be linked to your bank account and your trades.

Cons of WiseBanyan

The reasons below might be why you won’t like WiseBanyan.

- No access to human advisors

- Barebones platform (no research or educational material)

While it’s hard for any investment brokerage to compete with WiseBanyan when it comes to investing at the lowest price possible, it lacks the perks that go along with paying fees.

You don’t have the option of talking to a human advisor. This might not be as important if this is a secondary investment account or you have a small account balance, but, if you are a new investor or looking for “wealth management” will probably want the additional resources that full-service robo-advisors like Betterment, Personal Capital, or Wealthfront offer for an annual management fee of 0.25% or higher.

The WiseBanyan website is really simple & straightforward. Basically, the only three options you have are funding the account & starting a new investment goal, changing your risk tolerance, and withdrawing money. For some, this limited platform is too basic.

Is WiseBanyan Right for You?

WiseBanyan has a similar investment model to the other robo-advisors. They invest in high-quality low fee funds and they don’t charge fees. If you want a barebones investment account that allows you to keep as much money as possible, this is a good option. For those that want access to a financial advisor or a more “option rich” interface should consider another robo-advisor platform.